Last Updated on 05/23/2024 by qhbake

In the bustling landscape of the Mexican biscuit industry, understanding the numbers is key to unlocking growth and seizing opportunities. From consumption trends to market dynamics, a comprehensive industry analysis can illuminate the path to success for biscuit manufacturers, distributors, and retailers alike.

Join us as we delve into the numbers that define Mexico’s biscuit industry, offering valuable insights and strategic perspectives to inform your business decisions.

Whether you’re a seasoned player or a newcomer to the market, this analysis will provide a holistic view of the industry, empowering you to navigate its complexities with confidence.

What is the current size of the biscuit market in Mexico in terms of revenue and volume?

According to the IndexBox Market Intelligence Platform report, Mexico’s sweet biscuit exports saw growth for the fifth consecutive year in 2023, reaching 452,000 tons, a 3.7% increase. In terms of value, sweet biscuit exports rose significantly to $1.2 billion (IndexBox estimates). From 2013 to 2023, the average annual growth rate in volume to the United States was +11.9%, and in terms of value, the average annual growth rate was +14.4%. In 2023, the price of sweet biscuits was $2,730 per ton (FOB, Mexico), a 2.5% increase from the previous year.

The global biscuits market was valued at USD 104.32 billion in 2023 and is projected to grow from USD 108.75 billion in 2024 to USD 167.69 billion by 2032.

In Latin America, the total sales of biscuits are estimated to reach $25.29 billion by the year 2022.

Please note that these figures primarily focus on export volume and value rather than the total revenue and volume of the domestic market in Mexico. For specific data on the domestic market, further market research reports may be required to obtain detailed information.

2024 Biscuit Industry Analysis in Mexico: The Numbers You Need to Know

Which are the most popular biscuits in Mexico?

In Mexico, a diverse array of biscuits lines the shelves, catering to a variety of tastes and preferences. Among the most popular are traditional biscuits like Marias, which are simple, lightly sweetened cookies that serve as a versatile snack or accompaniment to hot beverages. These biscuits, with their delicate texture and buttery flavor, have long been a staple in Mexican households and are favored for their simplicity and comforting taste.

Another beloved biscuit in Mexico is the Galleta de Animalito, or “Animalito cookie,” which is a favorite among children and adults alike. These biscuits are often shaped like animals and are characterized by their crunchy texture and sweet, vanilla flavor. The fun shapes and flavors make them a hit with kids, while their nostalgic appeal resonates with adults who grew up enjoying them.

In recent years, there has been a growing trend towards healthier biscuits in Mexico, driven by consumers’ increasing focus on wellness and nutrition. Biscuits made with whole grains, such as oats or quinoa, have gained popularity, as have biscuits sweetened with natural ingredients like honey or agave syrup. These biscuits offer a healthier alternative to traditional options, appealing to health-conscious consumers looking for guilt-free indulgence.

Chocolate-flavored biscuits are also highly popular in Mexico, with brands offering a range of options from simple chocolate chip cookies to more elaborate chocolate-covered biscuits. These biscuits are favored for their rich, indulgent flavor and are often enjoyed as a special treat or dessert.

Overall, the most popular biscuits in Mexico are those that offer a balance of familiar flavors, nostalgic appeal, and innovative twists. Whether enjoyed with a cup of coffee as a morning pick-me-up or savored as a sweet treat, biscuits play an integral role in Mexican culinary culture, bringing joy and satisfaction to consumers of all ages.

-

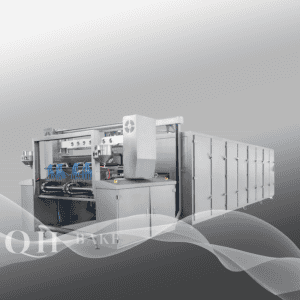

150 Auto starch less gummy candy depositing line: 60,000 gummies/h 280pcs of mold inside machine 8-10PH Cooling unit

-

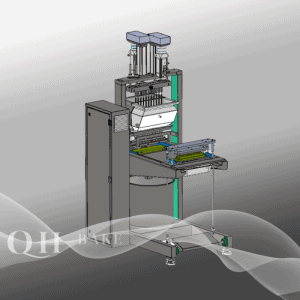

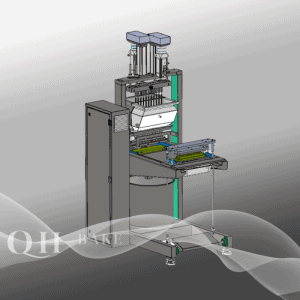

20S Servo-Form candy depositing Equipment: Cavity PCS: ±20; 100x80x160 Size(cm)

-

300 Auto starch less gummy candy depositing line 120,000 gummies/h 8-10PH Cooling unit 280pcs of twin-mold inside machine

-

50S Servo Control Candy Depositor: Servo; Cavity PCS: ±20; 200x100x170 Size(cm)

Which snacks are also growing in popularity in Mexico?

In addition to biscuits, several other snacks are experiencing a surge in popularity in Mexico, reflecting evolving consumer preferences and trends. One such snack is dried fruit, which is increasingly being consumed as a healthy and convenient alternative to traditional snacks. Dried mango, pineapple, and papaya are particularly popular choices, offering a naturally sweet and flavorful option for on-the-go snacking.

Nuts and seeds are also gaining popularity in Mexico, thanks to their nutritional benefits and versatility. Almonds, walnuts, and pumpkin seeds are among the most sought-after varieties, prized for their crunchiness and rich flavor. These snacks are often enjoyed on their own or used as ingredients in savory dishes and baked goods.

Another snack that is growing in popularity in Mexico is popcorn, which is appreciated for its lightness and versatility. Popcorn is enjoyed in a variety of flavors, ranging from classic butter and salt to more exotic options like chili and lime. Its low-calorie content and satisfying crunch make it a popular choice for health-conscious consumers looking for a guilt-free snack.

Finally, protein bars and energy bars are also seeing increased demand in Mexico, driven by consumers’ interest in convenient, on-the-go snacks that provide sustained energy. These bars come in a variety of flavors and formulations, catering to different dietary preferences and nutritional needs.

Overall, the snack market in Mexico is experiencing a shift towards healthier, more nutritious options, reflecting a broader trend towards wellness and mindful eating. As consumers become more health-conscious, they are seeking out snacks that not only satisfy their cravings but also nourish their bodies, driving growth in these categories.

What are some of the biggest threats to the Mexican biscuit industry?

The Mexican biscuit industry, like any other, faces a variety of threats that can impact its growth and profitability. Some of the biggest threats include:

- Health Concerns: Increasing awareness of health issues, such as obesity and diabetes, can lead consumers to reduce their consumption of biscuits and other sugary snacks. This trend has prompted biscuit manufacturers to innovate and offer healthier options to cater to changing consumer preferences.

- Competition: The biscuit market in Mexico is highly competitive, with numerous domestic and international brands vying for market share. Intense competition can lead to price wars and reduced profit margins, particularly for smaller manufacturers.

- Changing Consumer Preferences: Consumer preferences are constantly evolving, and biscuit manufacturers must stay ahead of trends to remain competitive. Failure to adapt to changing preferences, such as a shift towards healthier or more natural ingredients, can result in declining sales.

- Regulatory Changes: Changes in regulations, such as stricter labeling requirements or taxes on sugary snacks, can impact the biscuit industry. Manufacturers may be required to reformulate their products or face increased costs, affecting their bottom line.

- Economic Factors: Economic factors, such as inflation and fluctuations in currency exchange rates, can impact the cost of raw materials and production. This can squeeze profit margins and make it challenging for biscuit manufacturers to maintain competitive prices.

- Supply Chain Disruptions: Disruptions in the supply chain, such as natural disasters or political instability, can impact the availability of raw materials and disrupt production. This can lead to delays in product delivery and increased costs for manufacturers.

- Environmental Concerns: Increasing awareness of environmental issues, such as plastic pollution, can impact the packaging choices of biscuit manufacturers. Switching to more sustainable packaging options can increase production costs, affecting profitability.

Overall, the Mexican biscuit industry faces a range of threats that require manufacturers to stay vigilant and adapt to changing market conditions to remain competitive.

What opportunities exist for growth in the coming years?

Despite the challenges, several opportunities exist for growth in the Mexican biscuit industry in the coming years:

- Healthier Alternatives: There is a growing demand for healthier biscuit options, driven by increasing health consciousness among consumers. Manufacturers can capitalize on this trend by developing and marketing biscuits that are low in sugar, fat, and calories, as well as those made with natural and organic ingredients.

- Innovation in Flavors and Varieties: Consumers are increasingly seeking unique and exotic flavors in their snacks. Biscuit manufacturers can innovate by introducing new flavors and varieties that cater to these changing preferences, such as biscuits flavored with spices or fruits commonly used in Mexican cuisine.

- Convenience and Portability: With busy lifestyles becoming the norm, there is a growing demand for snacks that are convenient and easy to consume on-the-go. Manufacturers can capitalize on this trend by offering biscuits in convenient packaging formats, such as single-serve packs or resealable pouches.

- Expansion of Distribution Channels: The rise of e-commerce has opened up new opportunities for biscuit manufacturers to reach consumers. By expanding their distribution channels to include online platforms, manufacturers can tap into a wider market and increase their sales potential.

- Targeting Niche Markets: There are several niche markets within the biscuit industry that present opportunities for growth. For example, there is a growing demand for gluten-free and vegan biscuits, as well as biscuits targeted at specific age groups, such as children or seniors.

- Partnerships and Collaborations: Collaborating with other companies or brands can help biscuit manufacturers expand their reach and tap into new markets. For example, partnering with a popular coffee chain to offer biscuits as a snack option can help increase brand visibility and attract new customers.

- Export Opportunities: Mexico’s proximity to the United States and other Latin American countries presents export opportunities for biscuit manufacturers. By exporting their products, manufacturers can tap into larger markets and increase their revenue potential.

Overall, the Mexican biscuit industry has several opportunities for growth in the coming years, provided manufacturers are willing to innovate and adapt to changing consumer preferences and market trends.

What are the distribution channels used for biscuits in Mexico, and how are they evolving?

In Mexico, biscuits are distributed through a variety of channels, each serving a different segment of the market. Some of the key distribution channels for biscuits in Mexico include:

- Traditional Retail: Traditional retail channels, such as supermarkets, convenience stores, and independent grocers, remain the primary distribution channel for biscuits in Mexico. These outlets offer a wide range of biscuit brands and varieties, catering to diverse consumer preferences.

- Modern Retail: Modern retail formats, such as hypermarkets and large retail chains, are also important distribution channels for biscuits in Mexico. These outlets offer a wide selection of biscuits from both domestic and international brands, often at competitive prices.

- Online Retail: The rise of e-commerce has opened up new distribution opportunities for biscuit manufacturers in Mexico. Online retailers and e-commerce platforms allow manufacturers to reach consumers directly, bypassing traditional retail channels and expanding their market reach.

- Foodservice: The foodservice sector, including restaurants, cafes, and hotels, is another important distribution channel for biscuits in Mexico. Biscuits are often served as snacks or accompaniments to beverages in these establishments, creating opportunities for manufacturers to partner with foodservice providers.

- Direct Sales: Some biscuit manufacturers in Mexico use direct sales channels, such as door-to-door sales or direct marketing, to reach consumers. This approach allows manufacturers to build direct relationships with customers and tailor their offerings to meet specific needs.

The distribution landscape for biscuits in Mexico is evolving rapidly, driven by changing consumer preferences and the rise of digital technologies. E-commerce, in particular, is expected to play a larger role in the distribution of biscuits in Mexico, as more consumers turn to online shopping for convenience and variety. Additionally, manufacturers are increasingly using data analytics and technology to optimize their distribution networks, ensuring that biscuits reach consumers in a timely and cost-effective manner.

-

150 Auto starch less gummy candy depositing line: 60,000 gummies/h 280pcs of mold inside machine 8-10PH Cooling unit

-

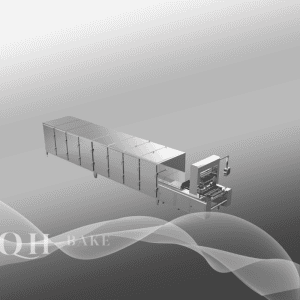

300 Auto starch less gummy candy depositing line 120,000 gummies/h 8-10PH Cooling unit 280pcs of twin-mold inside machine

-

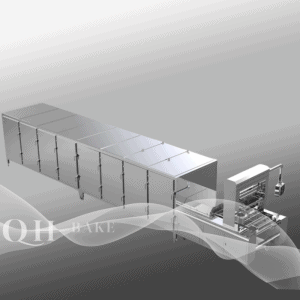

600 Auto starch less gummy candy depositing line: 240,000 gummies/h 10-20 PH Cooling unit 520pcs of twin-mold inside machine

-

80 Automatic Gummy Candy Production Line: 40,000 gummies/h 5-8PH Cooling unit 200pcs of mold inside machine

How are pricing strategies impacting the sales of biscuits in Mexico?

Conclusion

The biscuit industry in Mexico is expected to continue growing steadily in the coming years.

The rise in the consumption of snacks is expected to drive growth, while the increasing popularity of health and wellness products is expected to lead to the development of new products.

These trends create several opportunities for expansion and growth in the Mexican biscuit industry.

Moreover, the Mexican government has expressed interest in diversifying its agricultural production.

This is expected to lead to a rise in the production of high-value and high-quality products.

There is also a growing interest in local products among the Mexican population.

These trends have the potential to transform the Mexican biscuit industry significantly.

-

150 Auto starch less gummy candy depositing line: 60,000 gummies/h 280pcs of mold inside machine 8-10PH Cooling unit

-

20S Servo-Form candy depositing Equipment: Cavity PCS: ±20; 100x80x160 Size(cm)

-

300 Auto starch less gummy candy depositing line 120,000 gummies/h 8-10PH Cooling unit 280pcs of twin-mold inside machine

-

50S Servo Control Candy Depositor: Servo; Cavity PCS: ±20; 200x100x170 Size(cm)

-

600 Auto starch less gummy candy depositing line: 240,000 gummies/h 10-20 PH Cooling unit 520pcs of twin-mold inside machine

-

80 Automatic Gummy Candy Production Line: 40,000 gummies/h 5-8PH Cooling unit 200pcs of mold inside machine

-

Automatic Konjac Pearl Making Machine For Sales – Supplier & Manufacuture

-

Automatic Lollipop Production Line For Sale – Candy Machine Factory

-

Automatic Starch-less Depositing Production Line: Revolutionizing Candy Manufacturing